By Jesse Colombo, author of TheBubbleBubble

(Zero Hedge)—Following more than two months of stagnation after the U.S. presidential election, gold is now breaking out decisively, signaling its readiness to resume its rally toward $3,000 and beyond. While this recent pause has tested the patience of many investors, I’ve consistently maintained that it was a healthy consolidation phase, paving the way for even greater gains. Now, as I’ll demonstrate with numerous charts, gold is breaking out of its post-election trading range across nearly every major currency, reaffirming its bullish momentum.

In my view, the most important gold chart to monitor is the COMEX gold futures chart, priced in U.S. dollars. Over the past few months, a triangle pattern has taken shape—a formation that is typically a continuation pattern, suggesting the uptrend preceding it is likely to persist. Today, gold broke out of this triangle, an encouraging development. Notably, as I recently explained, a similar triangle formed in late 2007, and its breakout signaled substantial gains in the ensuing months.

To fully confirm that today’s breakout is genuine, I’m looking for a decisive, high-volume close above the key $2,800 resistance level. Breakouts above horizontal resistance levels carry greater validity than those above diagonal ones, making this milestone particularly significant. The $2,800 resistance level holds particular significance as it marked gold’s peak in late October before the recent pullback. Additionally, it serves as a key psychological level, reinforcing its importance in the eyes of investors.

The next critical chart to watch is gold priced in euros. This chart is particularly informative because it eliminates the influence of U.S. dollar fluctuations, providing a clearer view of gold’s intrinsic strength. Over the past two months, gold priced in euros has outperformed gold priced in U.S. dollars, largely due to the dollar’s strong rally, which has made gold seem weaker than it truly is. Just a few days ago, gold priced in euros closed above the key €2,600 resistance level—an all-time high—delivering a strong bullish signal.

Gold priced in Swiss francs recently closed above its 2,440 resistance level to hit an all-time high. This chart deserves close attention, as Switzerland plays a pivotal role in the global gold industry. With its renowned mints, world-class refiners, and a robust gold trading and banking sector, Switzerland remains an important hub for the international gold market, as I recently explained.

The chart below shows gold priced in euros, British pounds, and Swiss francs. I find that this particular mix shows gold’s movements very clearly. Gold priced in this mix of currencies recently closed above the key 7,200 resistance level signaling that the yellow metal’s bull market is ready to continue once again.

Gold priced in Canadian dollars recently broke out of a triangle pattern, signaling bullish momentum. For further confirmation, I’m looking for a decisive close above the horizontal 3,900 resistance level. This chart holds particular significance as Canada ranks among the world’s top gold producers, claiming the fourth spot globally with 200 metric tons of gold produced in 2023.

Gold priced in Australian dollars close above the key 4,250 resistance level, signaling a highly bullish development. Australia is the world’s second largest gold producer with 310 metric tons of gold produced in 2023.

China’s gold benchmark, the Shanghai Futures Exchange (SHFE) gold futures, closed above the critical 640 resistance level on Thursday. As the world’s largest producer of gold—producing 370 metric tons in 2023—and one of its largest consumers, China plays a pivotal role in the global gold market. For months, I’ve theorized that a resurgence of Chinese gold futures traders—who were instrumental in driving gold’s surge in March and April—could be the catalyst to propel prices toward $3,000 and beyond. I believe that today’s bullish breakout will turn that forecast into reality.

Gold priced in Singapore dollars recently broke out of a triangle pattern, signaling bullish momentum. For further confirmation, I’m looking for a decisive close above the horizontal 3,700 resistance level. This chart is particularly noteworthy, as Singapore is a key regional gold trading hub with growing influence in the global gold market. Its strategic position and expanding role in the gold industry make gold priced in Singapore dollars an important indicator to watch.

Gold priced in Hong Kong dollars also broke out of a triangle pattern, issuing a bullish signal. For further confirmation, I’m looking for a convincing close above the horizontal 21,600 resistance level. Like Singapore, Hong Kong serves as a major global banking and gold trading hub, making this chart worth monitoring.

Gold priced in Indian rupees is another important chart to monitor, as India, like China, is one of the world’s largest gold consumers. Gold priced in Indian rupees recently broke out of a triangle pattern and is now in the process of breaking above the 234,000 resistance level.

Gold priced in Japanese yen is still trading in a range between 390,000 and 428,000, but is likely to soon experience a breakout of its own as gold’s bull market heats up once again.

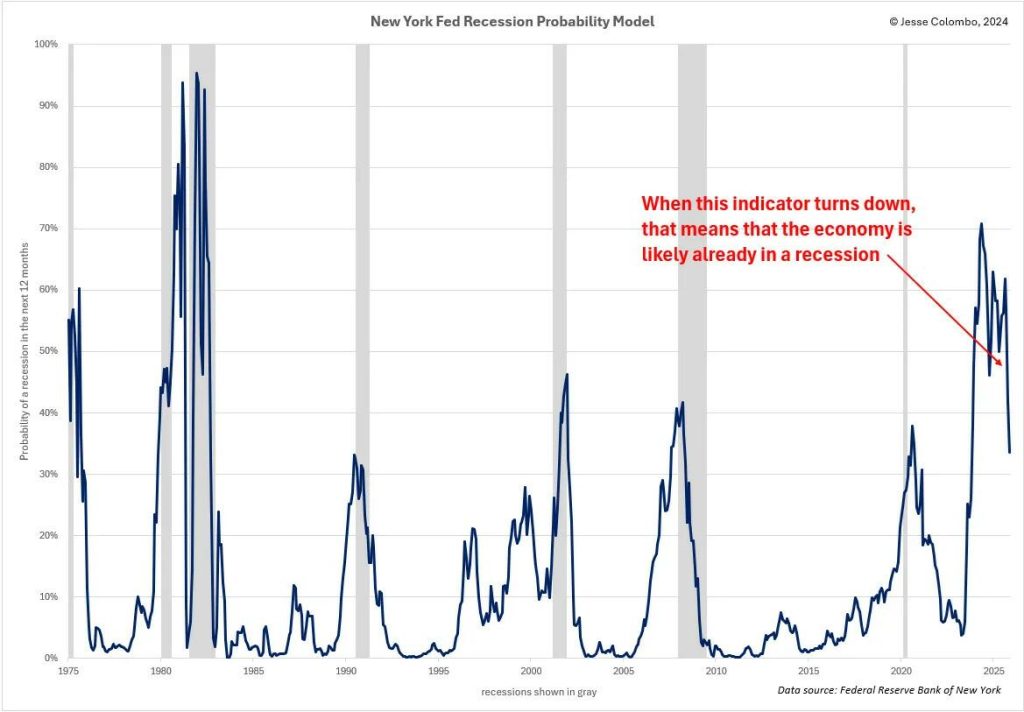

One key reason gold’s bull market is gaining momentum again is the increasing risk of a U.S. recession. Recessions are typically bullish for gold, as they lead to interest rate cuts and quantitative easing (QE)—essentially digital money printing. To explore the growing risk of a U.S. recession and its expected bullish impact on gold, be sure to read my related report.

There are other reasons to believe that gold’s bull market is still quite young. For example, there is a strong tendency for gold to continue to rise strongly after the first fed funds rate cut in a rate-cutting cycle. As the In Gold We Trust report aptly stated, “rate cuts are like rocket fuel for gold.” The report showed that over the past three rate-cutting cycles, gold has risen an average of 32% within two years of the initial rate cut. If gold follows a similar trajectory this time—following the Fed’s rate cut on September 18—it could rise to $3,380, representing a 25% increase from its current level of $2,714.

Another key reason gold’s bull market is still in its infancy is the massive bubble in the U.S. stock market, which will end in a significant bear market. This downturn will lead to a substantial transfer of capital from stocks into gold, as I explained recently. Notably, the Dow-to-gold ratio broke below its uptrend line in the spring of 2024, signaling that the rotation of capital from stocks to gold has already begun. This shift will gain momentum as the stock market bubble inevitably bursts.

In conclusion, gold is undergoing a significant breakout from its recent consolidation period, signaling the continuation of its bull market. This rally is poised to propel gold to $3,000 and much higher as the global paper money experiment inevitably unravels. Additionally, inflated asset prices, such as U.S. stocks, are destined to correct sharply, driving a massive shift of capital into safe havens like gold. While many investors remain bored or pessimistic about gold, now is the time for optimism. The outlook for gold is exceptionally bright, offering a promising opportunity for those paying attention.

If you enjoyed this article, please visit Jesse’s Substack for more content like this.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.

Kamala Harris Says the American Dream Is “Gone”

by Modernity News

During a pre recorded interview, Kamala Harris once again failed to deliver any substantive outline of her policies, primarily attacking Donald Trump’s outlook and his first term in office. At one point when speaking about the economy, Harris appeared to suggest, in stark contrast to Trump, that the American Dream…

Gold Price Forecasts Skyrocket Following Moves by China and the Fed

by Sponsored Post

With the Federal Reserve beginning what most expect to be a sustained easing cycle, momentum continues to rise for gold and silver. Values have been steadily rising and the newest forecasts point to even more gains down the road. At the end of September, BMO Capital Markets published updated commodity…

Taxes and Tariffs and Trade: Oh My! Trump’s Plan to Bolster the Economy

by Just The News

In a bid to build a broader coalition, former President Donald Trump has outlined a vision of tax cuts, import tariffs, and “reciprocal trade” to preserve and restore American industries. Since coming down the escalator of Trump Tower in 2015, the Republican standard bearer has espoused unconventional trade policies and…

Expert Testimony: Mass Immigration Under Biden-Harris Is Driving Up Rents for Americans

by Breitbart

The arrival of millions of foreign nationals, many of whom are illegal aliens, under President Joe Biden and Vice President Kamala Harris is helping to drive up rents for working- and middle-class Americans, an expert witness told Congress Wednesday. Center for Immigration Studies Director of Research Steven Camarota told the…

This Year Marks First Since 1958 That Us Held No Oil and Gas Lease Sales

by Just The News

This year will be the first year since 1958 that the Bureau of Ocean Energy Management held no offshore oil and gas lease sales. Energy expert Alex Epstein, author of “Fossil Future,” argued at a recent House Budget Committee hearing the United States’ record-high oil production is in spite of…

Kamala’s Devastating Middle Class Taxes

by Independent Sentinel

With the election coming up, the IRS plans to reduce our taxes for 2025. it’s a common tactic to make it seem like they won’t tax us into oblivion once they return to office. CBS News: Some Americans could see lower federal income taxes in 2025 due to an annual…

Congress Passes Stop-Gap Spending Bill After Failed Mike Johnson Gambit

by Breitbart

Congress on Wednesday passed legislation that would fund the government through nearly the end of December. The House and the Senate passed a stop-gap spending bill that would push the government spending deadline to December 20. The measure, otherwise known as a continuing resolution (CR), keeps federal spending the same….

A ‘Bipartisan’ Bar Tried to Open in DC, Then Libs Cried That an Elephant Image Was ‘Hurtful.’

by The National Pulse

A new bar in Washington, D.C., whose political theme focused on bipartisan agreement and debate, succumbed to partisan pressure before the establishment could even serve its first drink. Originally billed as Political Pattie’s, the bar was flooded with complaints by liberals who said the establishment’s logo—specifically the Republican Elephant—was offensive…

Newsom Signs Bill Requiring Janitors to Take $200 Sexual Harassment Training

by Just The News

California Gov. Gavin Newsom signed a bill requiring companies that hire janitors to make sure janitors take sexual assault training every other year, and pay $200 per participant for sessions with under 10 janitors present, and $8 for sessions with 10 or more janitors. The bill also requires the government…

Biden-Harris Regime Prepares Another $8 Billion in Military Aid for Ukraine During Zelensky’s Washington Visit

by The Gateway Pundit

The Biden-Harris regime is once again prioritizing foreign interests over the well-being of American citizens, with plans to announce an eye-watering $8 billion in military aid for Ukraine during Ukrainian President Volodymyr Zelensky’s visit to Washington. This massive giveaway comes as Americans continue to face economic hardships, skyrocketing inflation, and…

‘Economic Dystopia:’ Silicon Valley Tycoon Predicts AI Will Take Over 80% of All Work

by Breitbart

Vinod Khosla, legendary Silicon Valley investor and entrepreneur, has predicted that AI will replace the majority of work in most jobs, necessitating the implementation of universal basic income (UBI) to prevent economic instability and inequity. Fortune reports that in a recent blog post, Vinod Khosla, the billionaire co-founder of Sun…